The Australian budget squeaked into surplus thanks to China, although this contribution remained unacknowledged in Treasurer Jim Chalmers’ speech. For the first time in 15 years, the Australian budget delivered a positive result instead of a debt. The achievement is the result of an export income windfall with China remaining Australia’s largest export market.

These China contributions to the budget outcome are hidden under a generalized acknowledgement that the budget improvement is due to the global increase in commodity prices attributed to the Ukraine conflict. In 2008, China pulled Australia from the clutches of the global financial crisis with a massive infrastructure build that dramatically increased demand for Australian iron ore. In 2023, China once again pulled Australia from the worst of the long-term financial impacts of the COVID-19 pandemic with its sustained purchases of iron ore, coal and gas.

An increase in commodity prices carries no impact until commodities are sold to a customer; and for Australia, the largest customer remains China. China’s 2023 recovery is sustained by a dual circulation strategy and this has not involved a massive infrastructure spend similar to that in 2008. Instead the value of Chinese demand to Australia has increased because of the global increase in commodity prices.

The original budget forecasts were based on an assumption of $60 a tonne for iron ore. Instead, the price rose to over $160 a tonne. Every 10 Australian dollars ($6.77) increase in price improves Australia’s nominal GDP by 10.6 billion Australian dollars and boosts tax revenue by 2.9 billion Australian dollars. In 2022, Australia earned 92.8 billion Australian dollars from gas exports against an expected revenue of 44 billion Australian dollars. Forecast national debt levels were reduced with this unexpected commodity revenue.

Despite the exhortation to diversify markets, the truth is that Australia’s financial prosperity still rests significantly on Chinese demand for iron ore and other commodities. It is unfortunate that Australia fails to acknowledge these roots of its prosperity and its dependence on China.

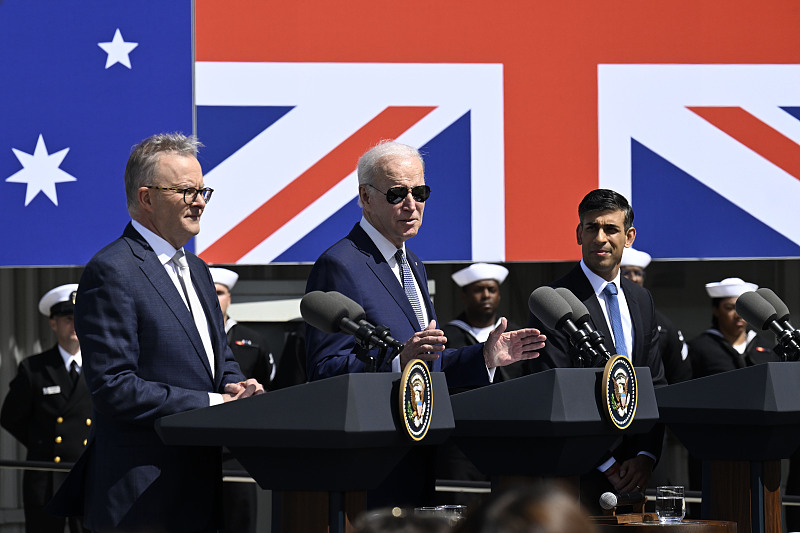

U.S. President Joe Biden, Australian Prime Minister Anthony Albanese and British Prime Minister Rishi Sunak they unveil AUKUS, a trilateral security pact between Australia, Britain and the United States, at Naval Base Point Loma in San Diego, California, U.S., March 13, 2023. /CFP

Lurking deep below the headline figures of the budget is the commitment to spend 368 billion Australian dollars for the purchase of AUKUS submarines. These figures do not take into account an increase in expenditure on other aspects of defense as a result of the Defense Strategic Review. Australia’s desire to become a forward base for the American military comes at a significant cost. Meeting these costs is based on the unspoken assumption that China will continue to support Australia’s ability to pay the horrendously large military costs for at least the next 30 years.

In effect, this means that the ability to fund the Australian defense build-up to support American aggression against China depends on China’s continued contribution to the wealth of the Australian economy.

This is not a short-term relationship. That is 30 years where Australia expects that China will continue to supply the bulk of Australia’s export income even though its defense build-up casts China as an adversary. Despite the rhetoric about exporters needing to diversify markets away from China, there is no realistic substitute market for these bulk commodities.

On the other side of the ledger, China has choices when it comes to sourcing commodities. New sources of iron ore are available and are under development. Improved relationships with countries in the Middle East provide access to alternative sources of gas, as do the development of new fields in Central Asia. High-quality coking coal for steel production is more difficult to replace, but the level of this demand is not sufficient by itself to guarantee Australia’s economic prosperity.

The relationship between Australia and China is of mutual benefit and there is no genuine reason it should not continue. It is a denial of reality when Treasurer Chalmers coyly hides this Chinese contribution to his budget success. Australian leaders and commentators remain smug in the belief that China is deeply reliant on Australian iron ore. Many regard this as a pressure point that both excuses and permits Australian belligerence. It is a dangerous path to take.

The rational response to this unwelcome funding of military intentions is to rapidly develop alternative markets, and that has significant impacts for both countries which may be beyond the ability of diplomacy to resolve.

Source: news.cgtn